Economists and market analysts, by nature of their work, typically must participate in the fraught exercise of predicting the future. Now, given the scale of COVID-19’s impact, the habit seems to have caught the imagination of the wider public as everyone tries to make sense of when the pandemic will end and allow the global economy to begin the recovery process. And in order to explain their prognoses to a broader (and keener) audience and help them visualise likely timelines, experts have begun relying on a number of creative aids.

Here, we take a look at some common, and a couple of not so common, shapes used to explain the economic trajectory - in alphabetical order so as not to betray our personal preference - that are finding their way into the thought leadership lexicon.

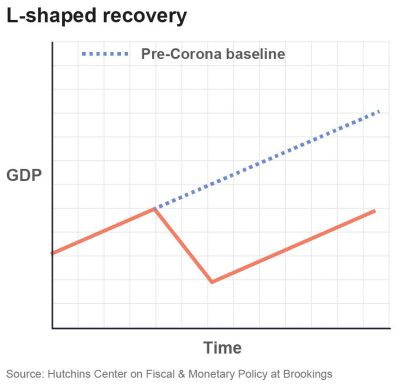

The L Shape: Representing perhaps the most pessimistic outlook of the options discussed here, the L-shaped curve denotes a view that COVID-19 will keep growth depressed below pre-pandemic levels for a prolonged period of time. While more seem to conform to the belief that the world will see some kind of a recovery in the near to mid-term, the L-shaped curve is not without its proponents.

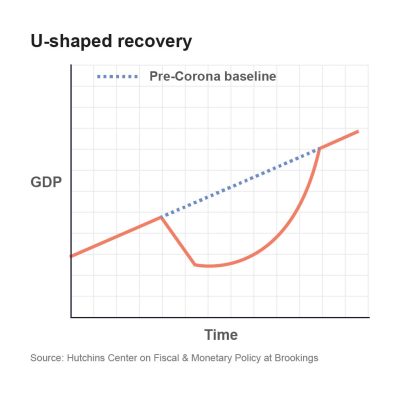

The U Shape: The U-shaped curve points to a slow and gradual recovery, with growth subdued for some time as countries around the world emerge from lockdown and attempt to revive economies atrophied from extended inaction. Many observers who had originally hoped for a sharper recovery seem to be moderating their views to expect a U-shaped growth curve as governments struggle to strike a tricky balance between reopening economies and staving off a second wave of the virus in the absence of a vaccine.

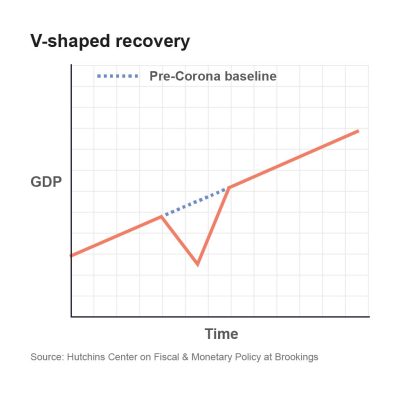

The V shape: This is the optimistic view that everyone is cheering for - a quick bounce-back to levels of expansion seen before COVID-19 upended the global economy. But while certain economists, including from prominent financial institutions such as Morgan Stanley are predicting a V-shaped recovery, others, including some fund managers, are not so sure. Then there are country-specific predictions: with the Bank of England’s economist, India’s chief economic adviser’s chief economic adviser and Turkey’s finance minister expecting V-shaped recoveries this year, while Singapore is expected by some to see one as well - but not until 2021.

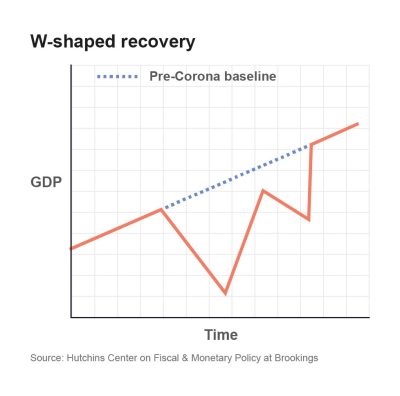

The W Shape: With the coronavirus having resurfaced in places where it was believed to have been largely wiped out – like Beijing and New Zealand – there are fears of a second wave of infections as governments gingerly emerge out of lockdowns and lift restrictions on social distancing. If the second wave does materialise, it could trigger a double-dip recession, or a W-shaped recovery, which some observers in the US and Australia have come to expect for their economies.

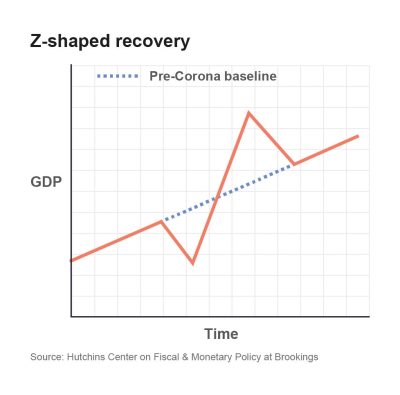

The Z Shape: The most sanguine of outlooks, the Z-shaped recovery theory holds that everything will not only snap back to business as usual once the pandemic subsides, but that pent-up demand and activity generated by a world emerging from an extended and collective lockdown will push growth to pre-pandemic levels and higher. Regrettably, given where the world is at now in dealing with the pandemic, there are not many subscribers to this view.

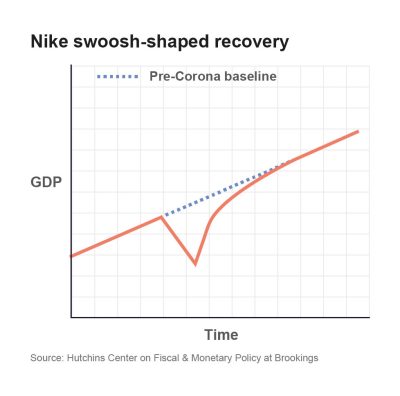

The Swoosh: Borrowed from the iconic Nike brand logo, the recovery depicted by this curve is closer to the U-shape than to the V. It implies that while demand and economic activity will bounce back in time, the road to recovery will be a long and gradual one.

Then there are the more elaborate (and obscure) variations on these themes, like the square root sign. This particular type of recovery is described as a V-shaped one that flattens out with a calming of economic activity before gradually recovering again. The inverted square root-shaped curve - originally attributed to George Soros after the 2008 financial crisis - which signifies a prolonged slowdown following a brief recovery after hitting bottom, is now finding renewed traction.

This is in line with the model espoused by outspoken economist Niall Ferguson, who is unconvinced about the chances of a V-shaped recovery for the US, and expects only a partial, sub-par recovery until a vaccine is discovered and social distancing measures can be lifted. He refers to this type of recovery as one resembling the inverted square root sign, or the back of a tortoise.

World-class content strategy and execution

Contact us to get started