More and more investors are now as concerned with the impact of their actions on the environment as they are with risk and returns. While profitability remains the end goal, investors also want their investments to align more closely with their values.

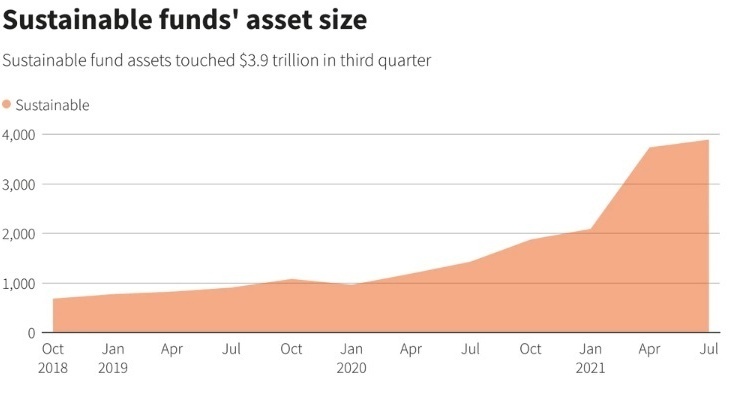

With the pandemic fuelling a rise in the focus on environmental, social, and governance (ESG) considerations, interest in sustainable investing is flourishing. Global funds focussed on ESG-related issues saw their combined assets hit a record high of US$3.9 trillion at the end of September 2021, according to data from Morningstar. In the first quarter of 2022, while sustainable fund flows across the world fell nearly 36%, they rose 21% in Asia, excluding Japan.

Source: https://www.reuters.com/busine...

As investors turn to impact investing in greater numbers, the pressure is growing on asset managers to keep returns front and centre while meeting sustainability targets. For asset managers seeking to strike this balance while navigating challenges including inconsistent data, a lack of uniform disclosure norms across markets, and instances of corporate greenwashing, Artificial Intelligence (AI) has become a valuable tool.

AI allows asset managers to stay competitive in the challenging ESG investing landscape by giving them the ability to process and analyse mountains of data churned out by companies, rating agencies and regulators at incredible speeds to make the correct investment decisions. It’s not surprising then that the global market for the use of AI in asset management is expected to be worth US$13.4 billion over by 2027.

How AI is catalysing sustainable investing

The deployment of AI in ESG investing is growing for sure. But how is it helping asset managers and investors, and to what extent?

First and foremost, as investors grow keener to pour money into companies with strong ESG profiles, the question of what constitutes a robust sustainable profile is front and centre.

ESG-related information tends to be self-reported by companies, often leading to positive bias, or the omission of negative incidents or risks. And even as regulations around corporate sustainability commitments and disclosures become more stringent, there is plenty of room for interpretation. A company’s ESG disclosures may imply it is growing sustainably, but a closer look could tell a different, or a more nuanced story.

An asset manager can use AI-powered machine learning tools to go beyond disclosure-based ESG information to crunch masses of data and counteract an over-reliance on self-reporting, which also safeguards investors from being misled by corporate greenwashing.

For instance, J.P. Morgan Asset Management uses AI-based algorithm called “Themebot” to identify relevant information from unstructured data and scan for keywords in patent filings to identify companies that are linked to new low-carbon technology.

Measurability is also key as investors now want to be able to assess exactly how sustainable their portfolios actually are – which requires a high degree of transparency and granular details on the practices of the companies in question. Platforms such as Clarity AI use machine learning and AI technologies to deliver aggregate sustainability scores for entire portfolios and individual stocks, and are able to break down the components of the scores based on whether the data is reported or estimated.

Uncovering hidden risks with NLP

In-depth evaluations of companies are also made possible by the use of sentiment analysis algorithms. These use natural language processing (NLP) technology to scrutinise the tone of a conversation on conference calls or analyst meetings, helping an asset manager dive deeper into how a company’s operations directly or indirectly impact the environment around it.

NLP is also good at identifying hidden ESG risks beyond public disclosures, zeroing in on parts of a statement or a conversation that talk about sustainability-related topics and then gauge levels of the company’s commitment to mitigating climate risks. For instance, Acadian Asset Management uses NLP and machine learning to comb transcripts of executives at conferences, shareholder meetings, or on analyst calls to look for intangible red flags such as vagueness or evasiveness, and even flag a meandering response as a “non-answer.”

Furthermore, AI can quickly execute repeatable tasks, helping fund managers build ESG-aligned portfolios like Arabesque’s recently released ‘AutoCIO’ platform, which harnesses AI to create and deliver customised and sustainable investment strategies in minutes.

Is AI really the cure-all sustainable investing needs?

Despite its various merits, the use of AI is not without its shortcomings.

First, there is the elephant in the room – the high environmental cost of deploying AI to build these strategies in the first place. Creating, training, and running AI algorithms needs large amounts of computing power, which is energy intensive. One study estimated that training network architecture can emit more than 626,000 pounds of CO2, or the equivalent of about 300 round-trip flights between New York and San Francisco.

Another major concern regarding the growing reliance on AI is that the unchecked use of algorithms can result in decisions that are systemically unfair to certain groups of people. This is because human biases can filter through to AI systems, which have been found to demonstrate racial bias by attaching less value to words spoken by certain races.

But there is a growing recognition that AI technology is not foolproof and efforts are on to understand how to rid it of the biases that plague human decision-making processes. In conclusion, the use of AI in asset management may very well be a science in theory, but, much like accounting and investing itself, it is an art in application.

World-class content strategy and execution

Contact us to get started